Notice Of Proposed Property Tax Increase

Millage Rate to be Reduced for First Time Since 2003

The city of Sugar Hill has tentatively adopted a reduced 2023 millage rate of 3.69 mils, the first tax rate cut in 20 years. The city millage rate has remained at 3.8 mils since 2003. Without this tentative millage rate reduction, the tax increase would be 16.83%, and the millage rate would be no more than 3.409 mills. The tentatively adopted millage rate of 3.69 mils would reduce the tax increase to 13.45%.

The increase in revenue over 2022, using the current millage rate of 3.8 mils, is the result of the reassessment of property values by the Gwinnett County Board of Tax Assessors as well as new construction added to the city tax digest over the last year, not an actual increase in the millage rate.

The proposed tax increase for a homestead property in the city with an average fair market value of $450,000, at the proposed reduced millage rate of 3.69, is approximately $50.00 per year; the proposed tax increase for a non-homestead property in the city with an average fair market value of $475,000, at the proposed reduced millage rate of 3.69, is approximately $54.00 per year.

All concerned citizens are invited to attend the public hearings to be held at City Hall, Council Chambers, 5039 West Broad Street, Sugar Hill, Georgia on the following dates and times:

Monday, August 7, 2023 at 8:30 a.m. – Public Hearing #1

Monday, August 7, 2023, at 6:45 p.m. – Public Hearing #2

Monday, August 14, 2023 at 7:30 pm – Public Hearing #3

The Mayor and Council will hold their regular monthly meeting on Monday, August 14, 2023, at 7:30 p.m. and will conduct the third and final required Public Hearing before taking action to adopt the 2023 millage rate.

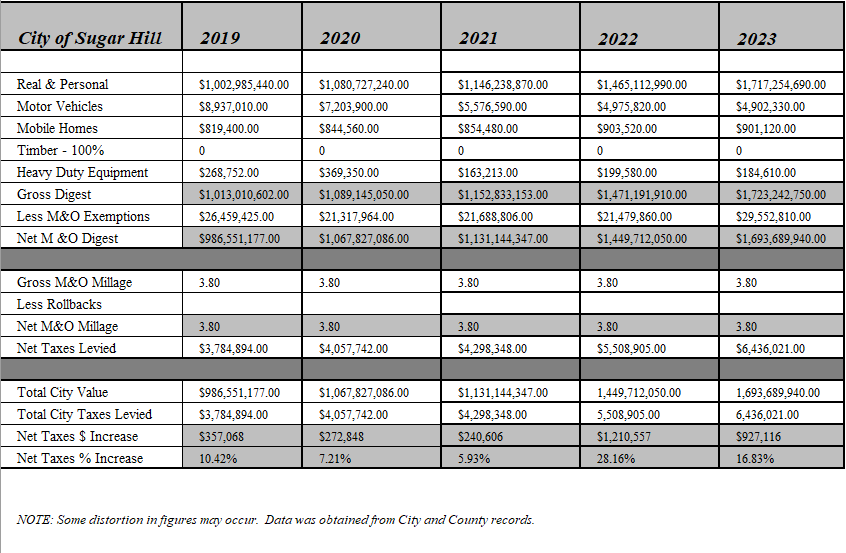

CURRENT 2023 TAX DIGEST AND 5 – YEAR HISTORY OF LEVY

The City of Sugar Hill does hereby announce that the millage rate will be set at a meeting to be held in the City Hall Council Chambers located at 5039 West Broad Street, Sugar Hill, Georgia 30518 on Monday, August 14, 2023 at 7:30 p.m. Pursuant to the requirements of OCGA 48-5-32 the city does hereby publish the current year’s tax digest and levy along with the history of the tax digest and levy for the past five years.